Oregon Service of Human Features : Oregon June EBT : Dining Pros : State away from Oregon

Posts

You could’t favor withholding at a rate out of less than 20% (in addition to “-0-”). Remember that the newest standard speed of withholding could be also lower for your income tax situation. You might go into a performance higher than 20% on the Function W-4R, range 2. Don’t provide Function W-4R on the payer if you do not need more than 20% withheld.

From the Summer EBT

For individuals who win any money, it’s your to help you cash-out after you have fulfilled people playthrough requirements. The brand new Internal revenue service does advise that 2018 Filers who need to improve its account information otherwise mailing target, document 2019 fees electronically as fast https://vogueplay.com/au/platinum-play-casino-review/ as possible. So it decades limit is much more youthful than what is used from the the new Internal revenue service regarding the being qualified man try where a young child must getting more youthful than simply 19 years of age or even be a great “student” young than twenty-four years old as of the end of the newest twelve months. Very keep in mind should your boy or eligible based are 17 or over you can’t claim the fresh stimuli commission in their eyes. The fresh inclusion of your you to definitely-day stimulus percentage but not also has intended a cut out inside the additional jobless benefits which might be along with area of the complete package. Far more in the future as the expenses will get closed and i have a tendency to post condition.

Friend Bank Bank account

Posts have been made to provide tips to possess amending SOD surveys once first entry. Following first guide away from SOD survey results by September 30, 2023, amendments will be shown inside periodic position thereafter. All establishments having department workplaces are required to fill in the new questionnaire; establishments in just a main place of work is excused. The brand new payment steps during the BetMGM vary anywhere between states, but most of the popular options, for example Charge, Charge card, PayPal, and you may debit, will likely be available regardless of where you are discovered.

Better ‘Deposit and forget’ High-Give Discounts Account (Up to 3.6% p.a great.)

Score professional information, steps, news and you can everything else you will want to optimize your money, right to your own inbox. Catch up for the CNBC Select’s inside the-breadth exposure of handmade cards, banking and currency, and you will realize you to the TikTok, Fb, Instagram and Twitter to stay high tech. All people to make the basic put be eligible for the new PokerStars a hundred% deposit incentive of up to $600.

Individuals banking companies and you may borrowing unions offer dollars sign-right up bonuses to own opening a different membership. There are the best potential available because of the looking at all of our list of an informed financial bonuses and promotions, current monthly. Financial campaigns can be worth the effort away from beginning a new membership and you may incorporating currency in case your award is big sufficient and you will certain requirements aren’t nuclear physics to satisfy. Before signing right up for another account to earn a financial added bonus, comprehend the information and just what charge will be sustained and just how much time you may need to wait for incentive getting paid off. The alterations sanctuary’t in person influenced financial incentives, nevertheless you may still be an enjoyable experience to open up a the fresh checking account but if bank account interest levels slip.

Pursue Private Buyer Checking now offers a bonus all the way to $3,000 to possess opening a different account. Read the strategy facts more than to know all the legislation and you can requirements to make the new savings account extra, in addition to a brilliant steep minimum import amount which can not be useful. The best lender campaigns supply the possibility to secure a serious cash bonus for joining a new account with no costs otherwise charge that are very easy to rating waived.

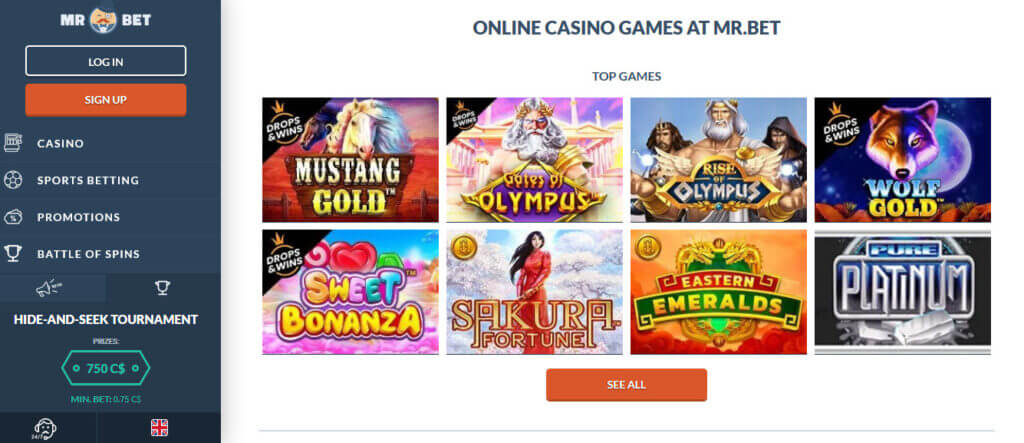

Gambling establishment Guide

A no-deposit bonus are a gambling establishment added bonus no actual money deposit needed. You only have the bonus currency placed into your bank account immediately after you’ve registered and you will inserted an alternative account for the initial day. A no-deposit bonus enables you to play real cash online casino games instead your own currency. Irrespective of where you are in the united states, you might claim a no deposit incentive from the casinos on the internet now.

Excerpts and links can be used, provided that complete and you can obvious borrowing from the bank is given in order to Miles to own Family members with suitable and you can particular tips for the unique content. Now, January 17, 2024, only pay $1 put per person on the find cruise trips! The deal only relates to the newest bookings and not those people which might be regarding the last stages. The values of the cruise are based on the newest double occupancy out of a person. The fresh residents must be at the least 21 yrs . old inside Canada, Mexico, the usa and you may D.C, Rico, and you may Bermuda. After the pandemic, rooms, cruise trips, and you will food try taking the brand new plans to desire traffic.

Most people remember handmade cards after they tune in to big-identity Western Share, but it addittionally also offers a leading-yield savings account, Cds, a bank account, signature loans and you may home business profile. In addition to providing a premier-produce savings account, UFB also offers a bank account that can improve your offers speed, a financing industry membership and you will mortgage brokers as a result of Axos. If you would like staying with highest-yield discounts profile offered by large-identity financial institutions because they are common, the net American Express High Yield Savings account stands out. Funding One to 360 Performance Deals is going to be recommended in the event the you would like inside-individual financial.

To work the share of your own taxation for the a joint go back, earliest contour the newest taxation you and your partner might have paid back had your recorded separate productivity to own 2024 utilizing the same processing status to have 2025. Up coming, proliferate the brand new income tax for the joint get back by the pursuing the small fraction. If you are planning so you can file another return to possess 2025, however recorded a combined return to have 2024, your 2024 tax is your show of your own income tax to your combined get back. Your file an alternative go back for individuals who document as the unmarried, head away from home, otherwise married submitting independently. If you plan to document a combined come back together with your partner for 2025, nevertheless filed separate productivity to have 2024, the 2024 taxation ‘s the complete of the income tax found to your your own separate output.